Common factor models

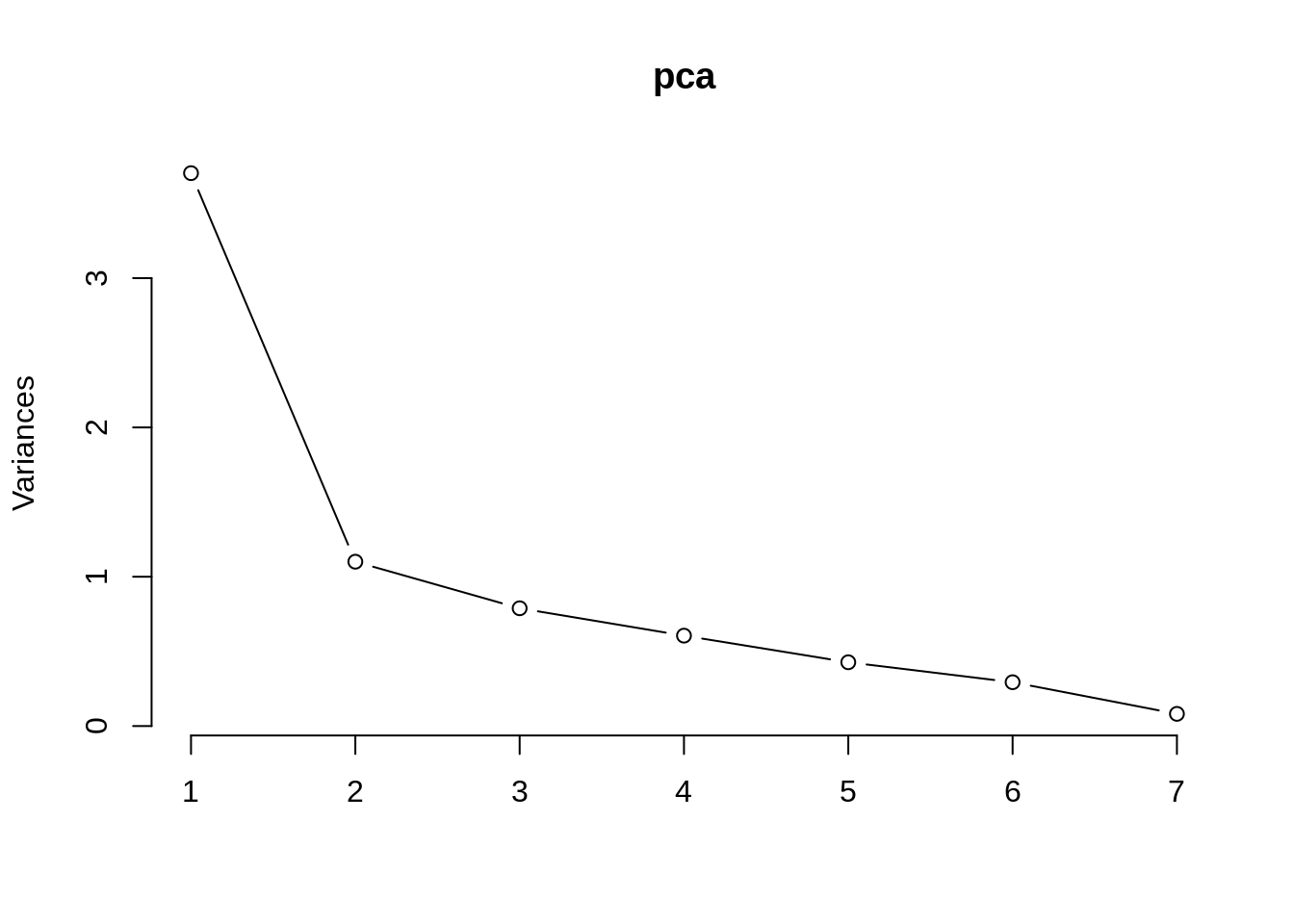

hprice2$fact <- scale(pca$x[,1])

var(hprice2$fact)

## [1] 1

# modeling with the factors

model0 <- lm(log(price)~log(nox),data=hprice2)

summary(model0)

##

## Call:

## lm(formula = log(price) ~ log(nox), data = hprice2)

##

## Residuals:

## Min 1Q Median 3Q Max

## -1.17062 -0.19368 -0.02582 0.18385 1.09366

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 11.70719 0.13243 88.40 <2e-16 ***

## log(nox) -1.04314 0.07767 -13.43 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.3516 on 504 degrees of freedom

## Multiple R-squared: 0.2636, Adjusted R-squared: 0.2621

## F-statistic: 180.4 on 1 and 504 DF, p-value: < 2.2e-16

model1 <- lm(log(price)~fact,data=hprice2)

summary(model1)

##

## Call:

## lm(formula = log(price) ~ fact, data = hprice2)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.78445 -0.16469 -0.03504 0.14551 1.24032

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 9.94106 0.01219 815.47 <2e-16 ***

## fact -0.30404 0.01220 -24.92 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.2742 on 504 degrees of freedom

## Multiple R-squared: 0.5519, Adjusted R-squared: 0.551

## F-statistic: 620.8 on 1 and 504 DF, p-value: < 2.2e-16

model2 <- lm(log(price)~log(nox)+fact,data=hprice2)

summary(model2)

##

## Call:

## lm(formula = log(price) ~ log(nox) + fact, data = hprice2)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.77893 -0.16266 -0.03565 0.14315 1.23570

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 9.67179 0.15239 63.468 <2e-16 ***

## log(nox) 0.15904 0.08972 1.773 0.0769 .

## fact -0.32771 0.01807 -18.135 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.2736 on 503 degrees of freedom

## Multiple R-squared: 0.5547, Adjusted R-squared: 0.5529

## F-statistic: 313.3 on 2 and 503 DF, p-value: < 2.2e-16

c(AIC(model0),AIC(model1),AIC(model2))

## [1] 382.0341 130.6135 129.4623

c(BIC(model0),BIC(model1),BIC(model2))

## [1] 394.7137 143.2931 146.3684

Time series factor models

french <- fread('french.csv')

french$Date <- as.Date(french$Date)

panel <- french[,2:50]

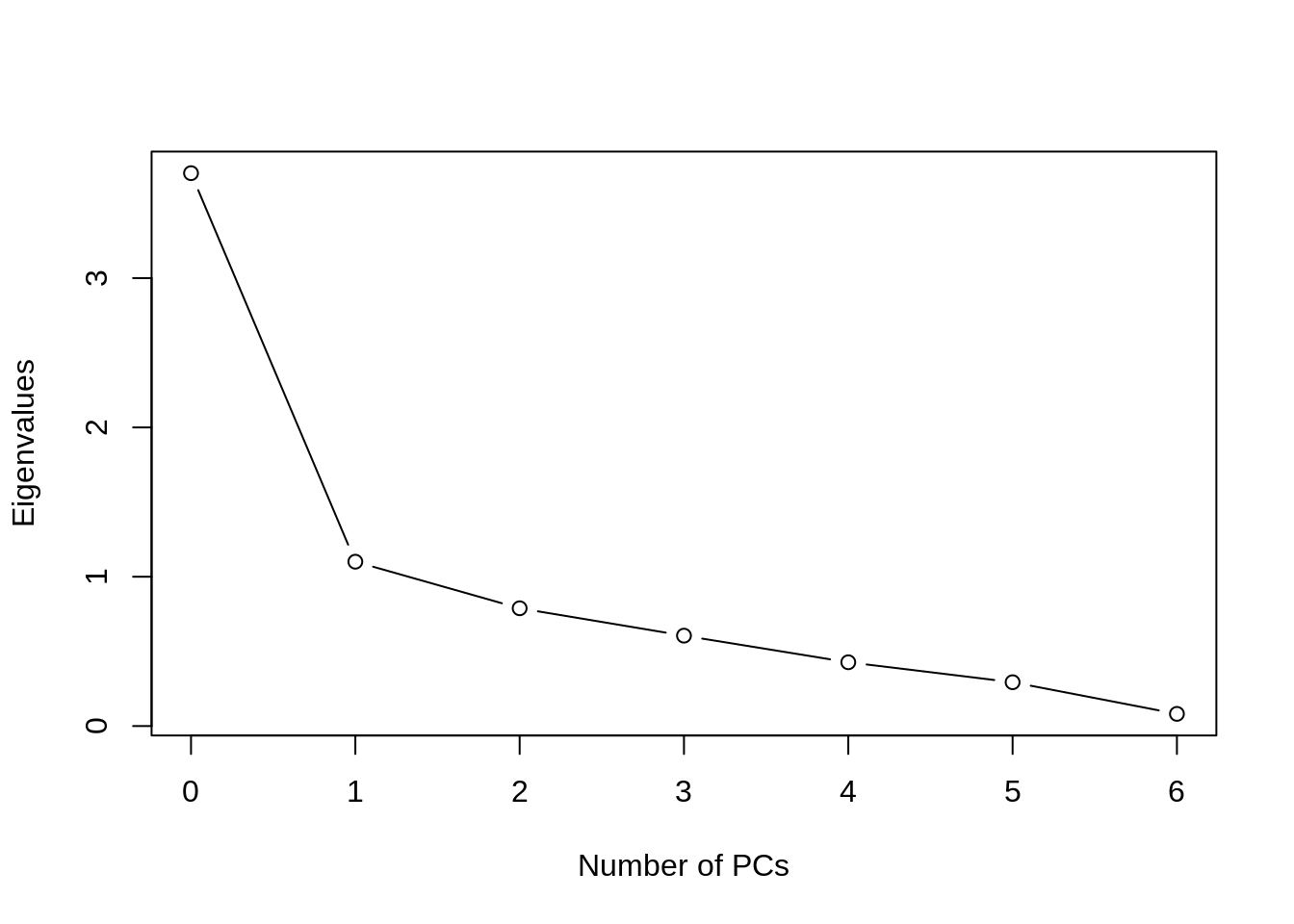

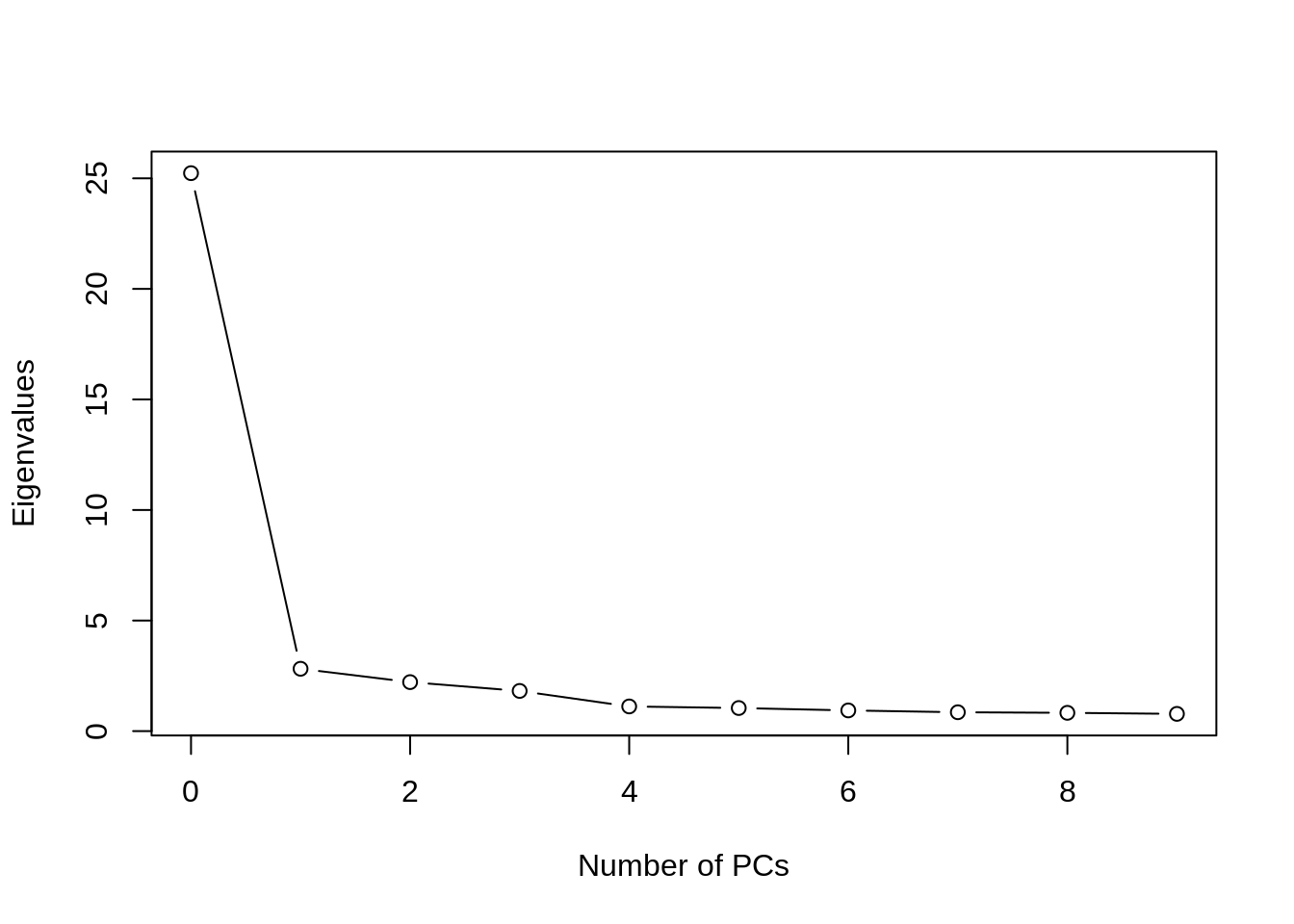

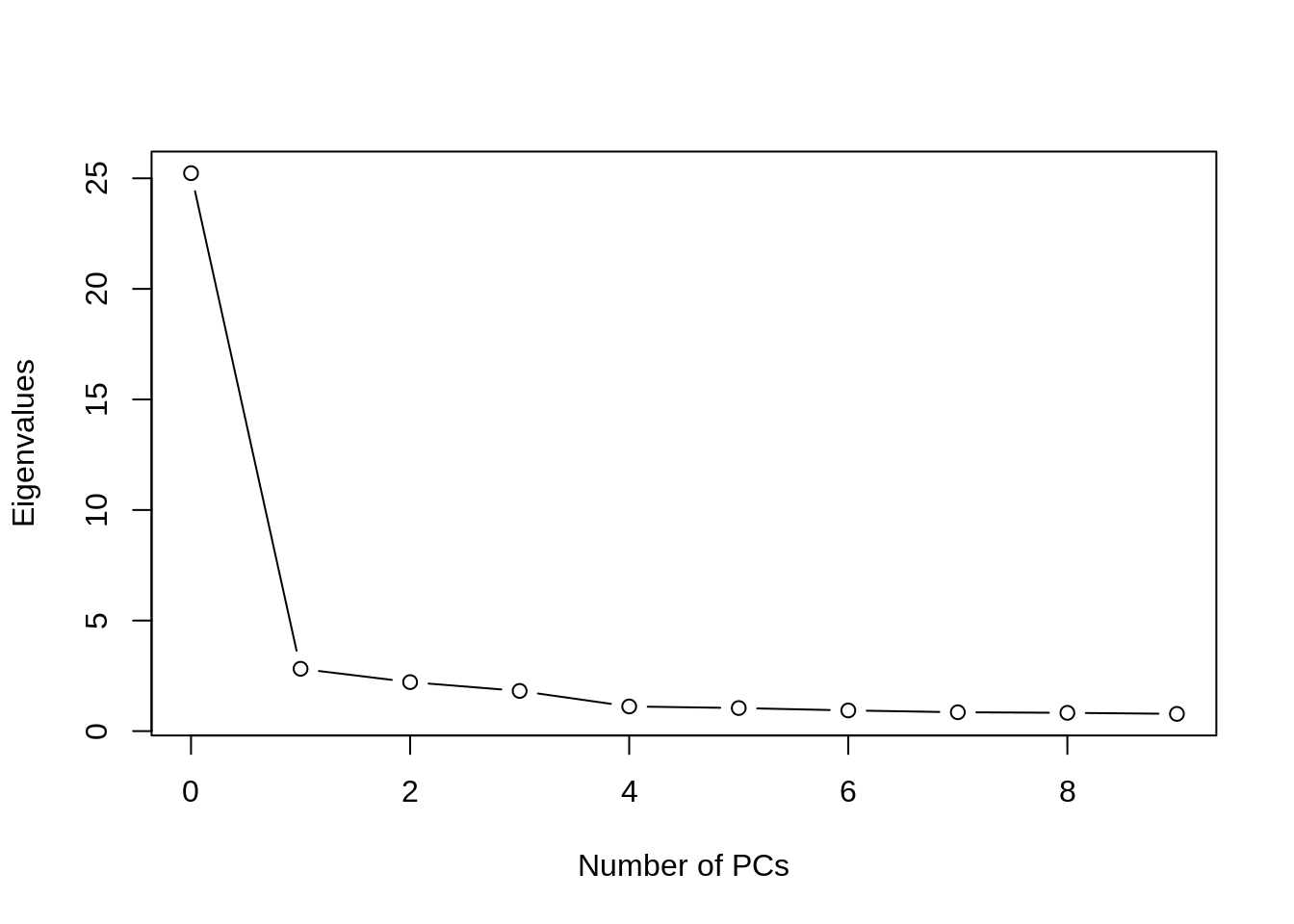

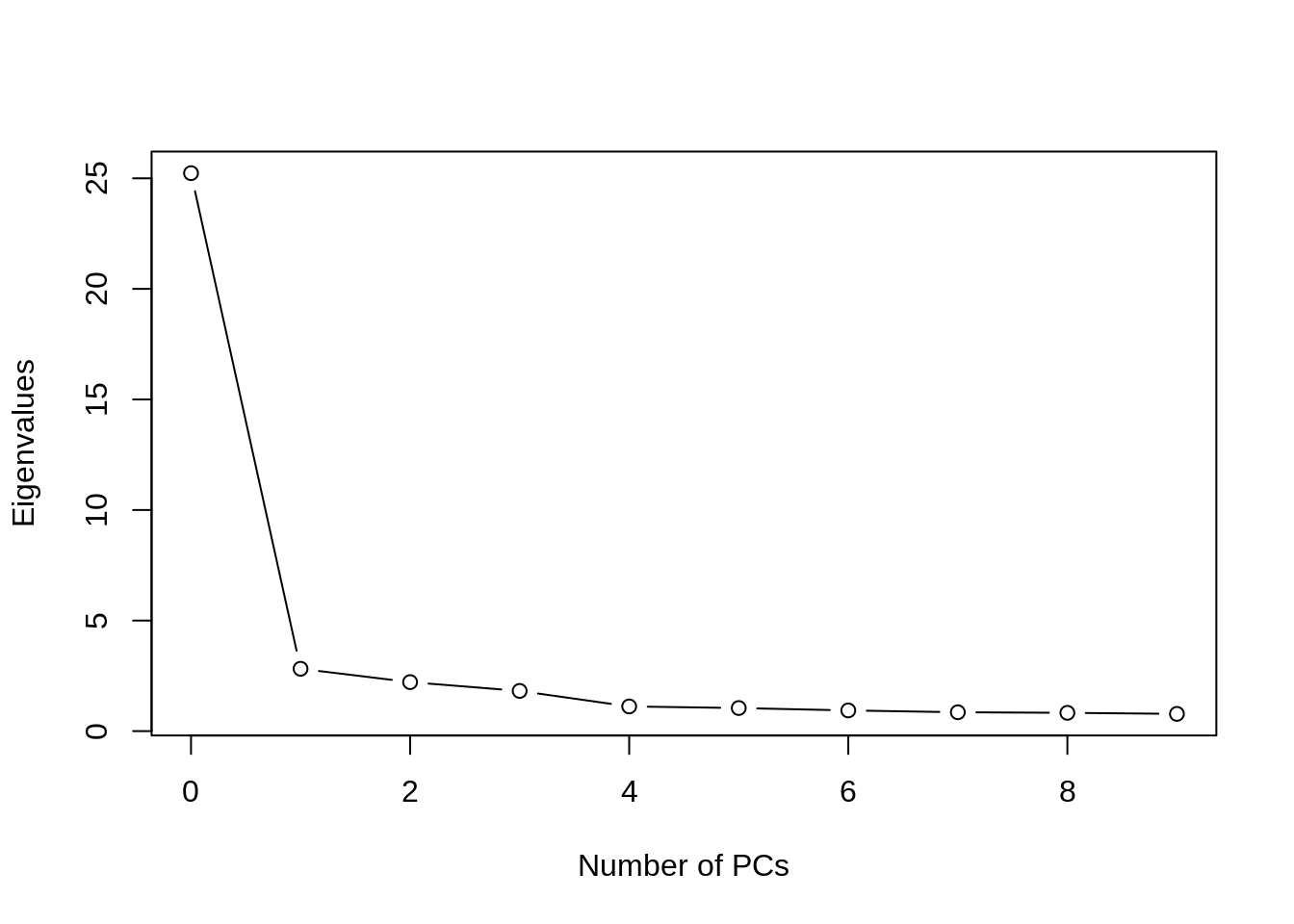

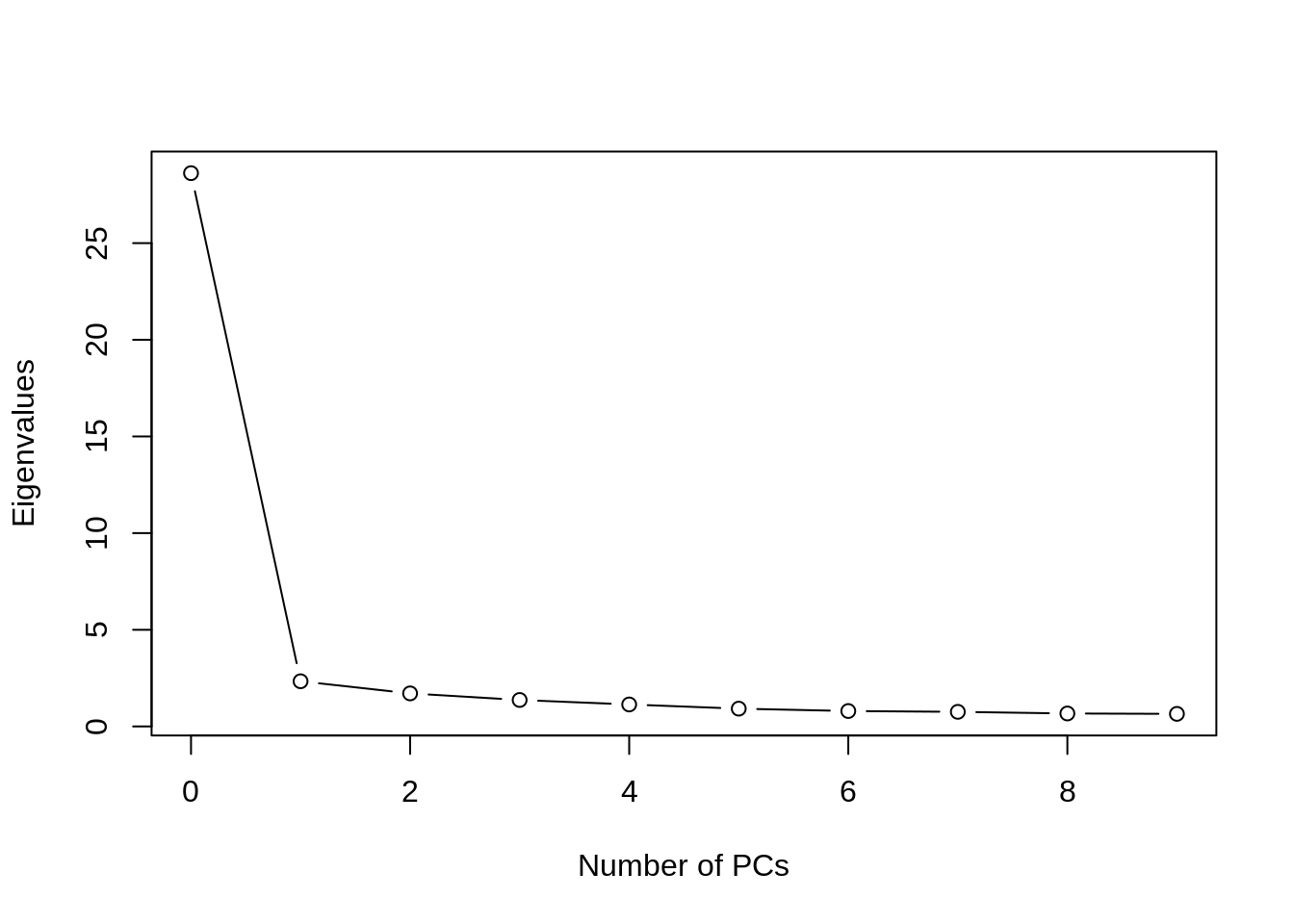

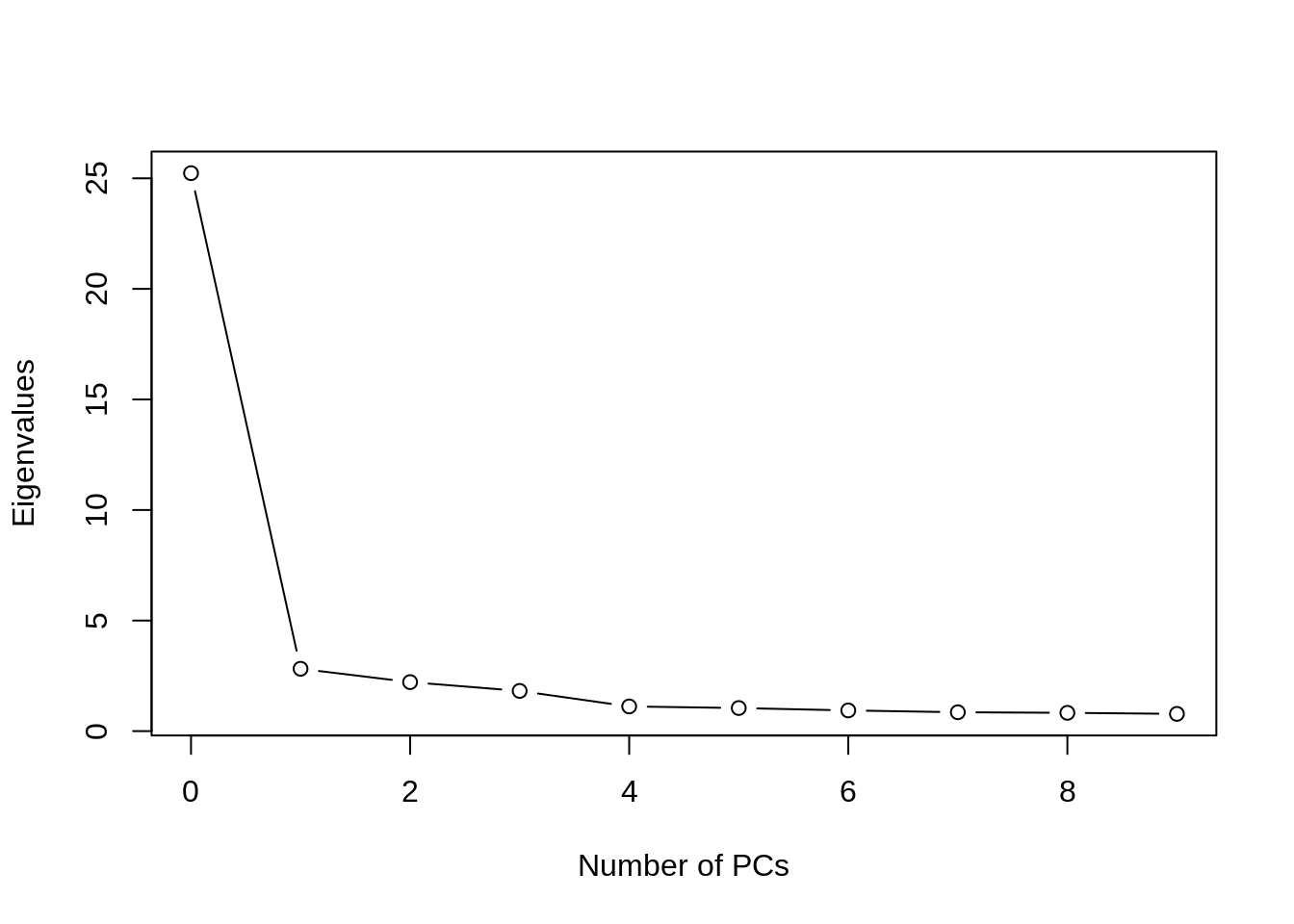

pca <- prcomp(panel,scale=TRUE)

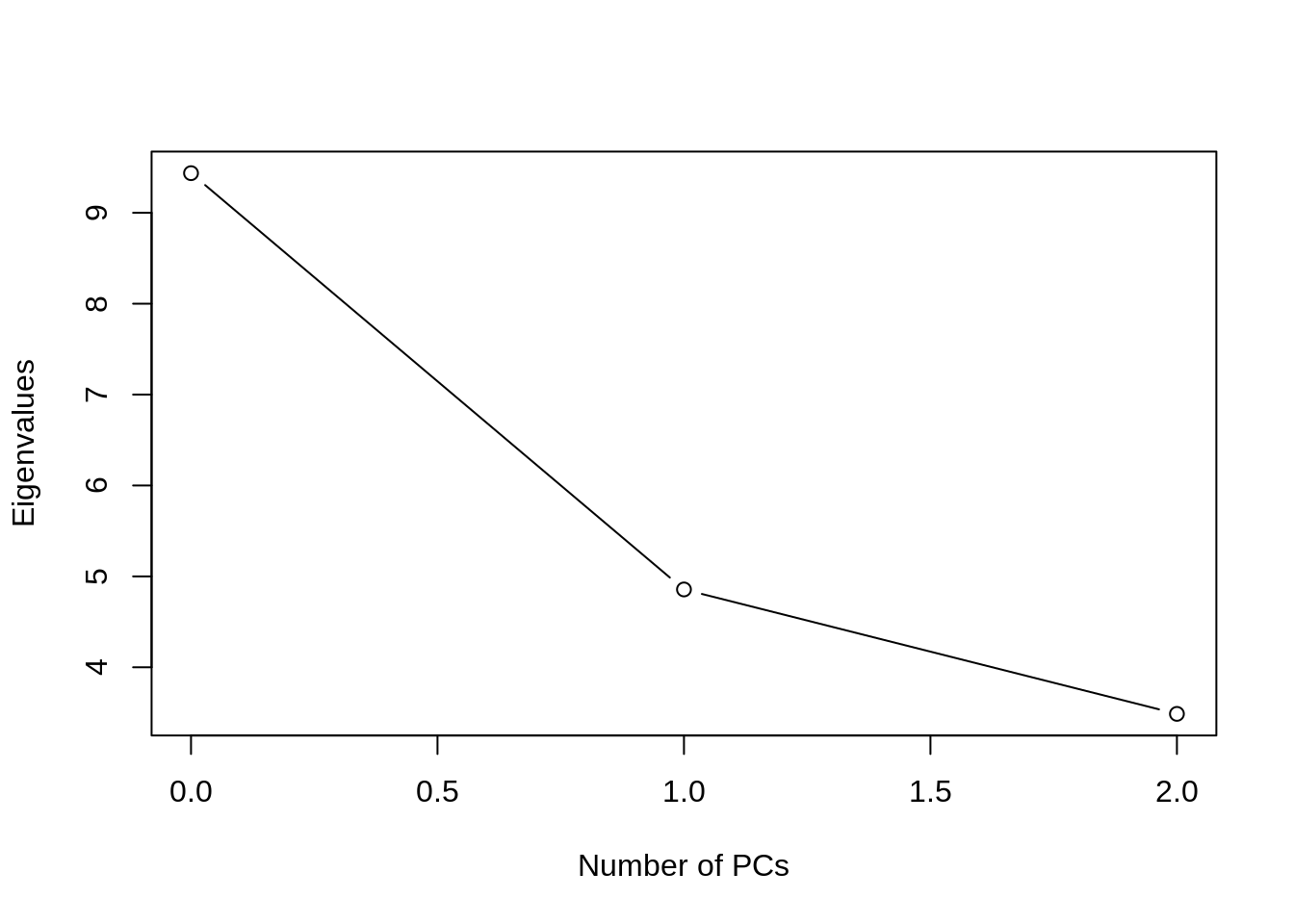

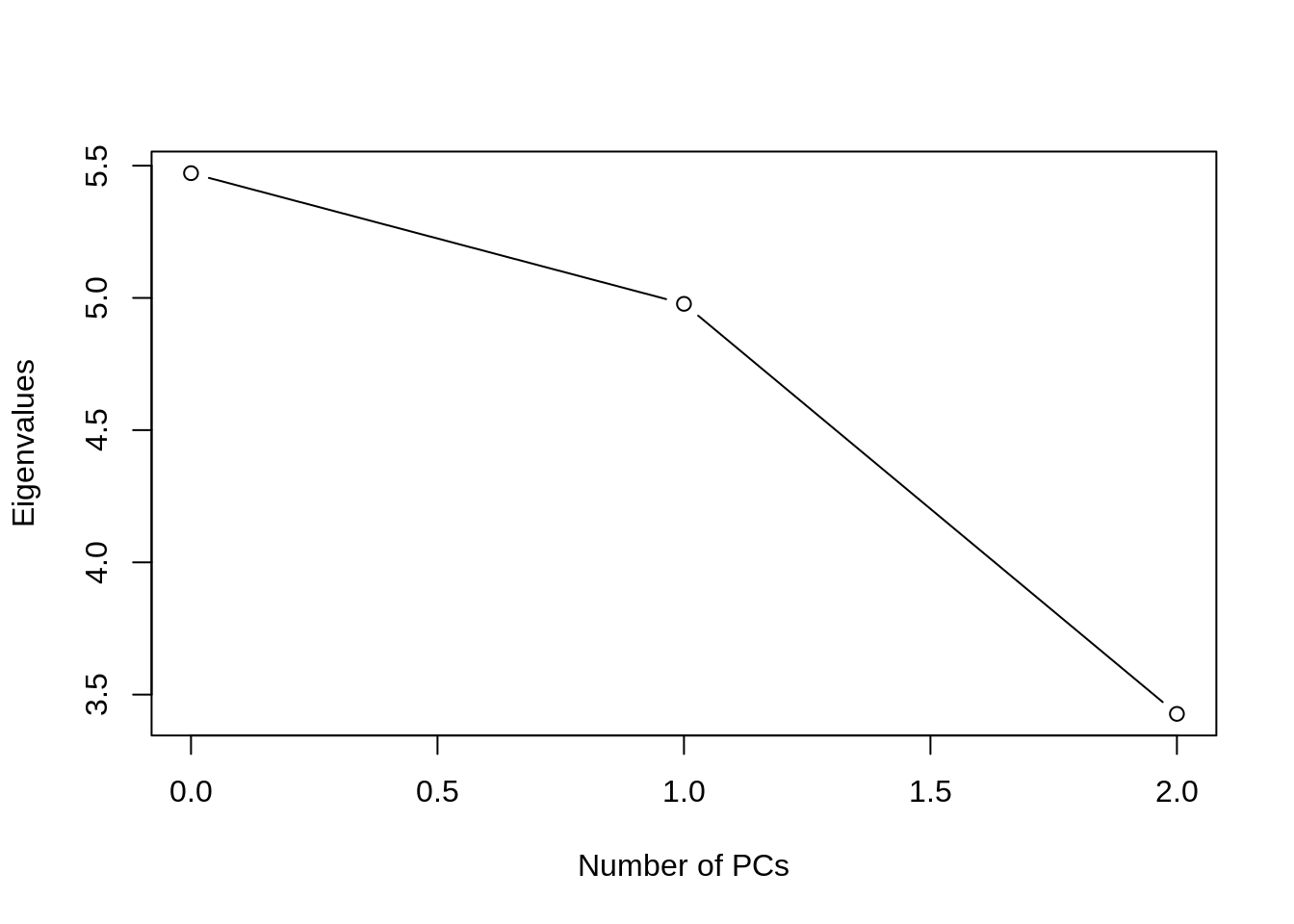

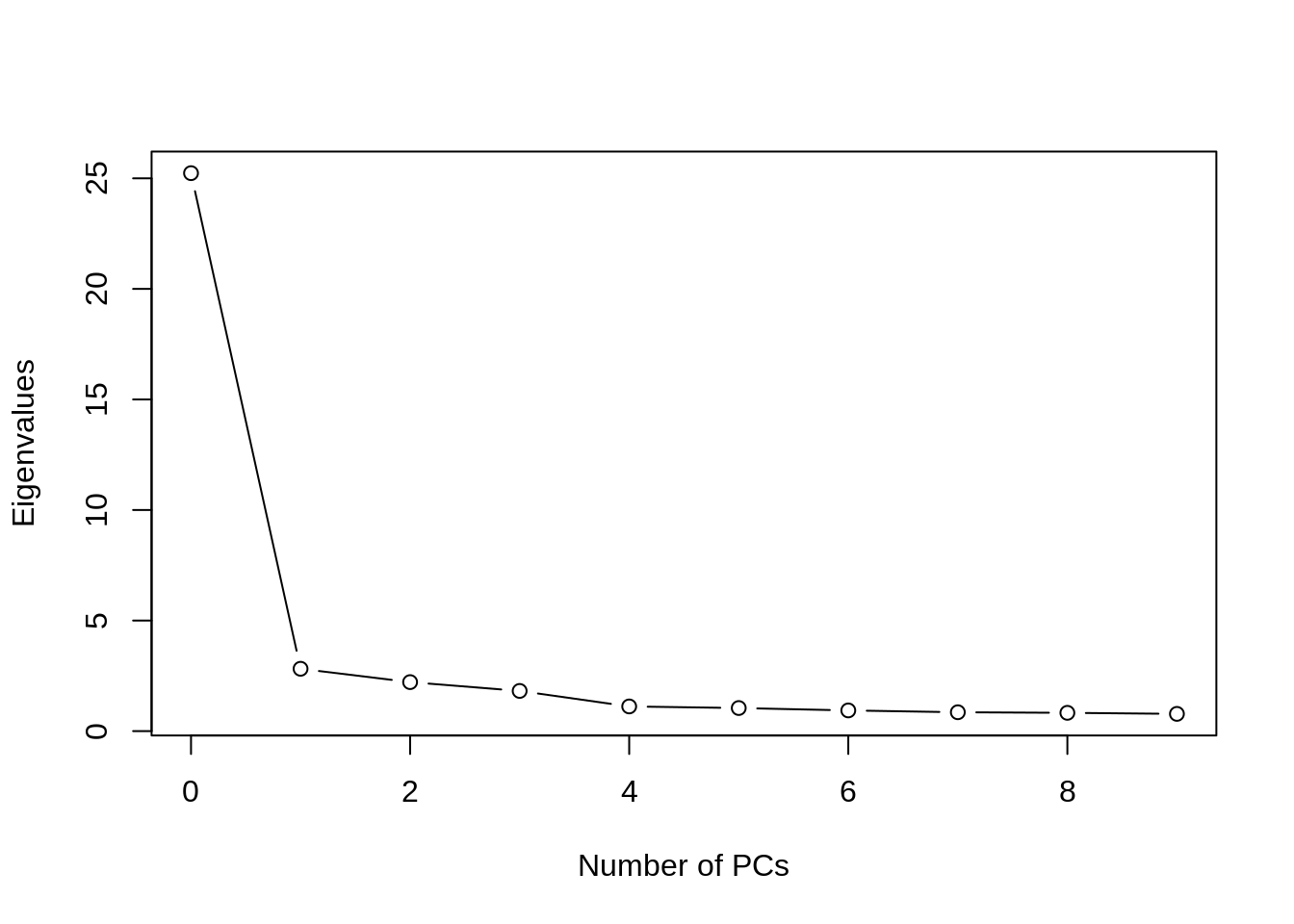

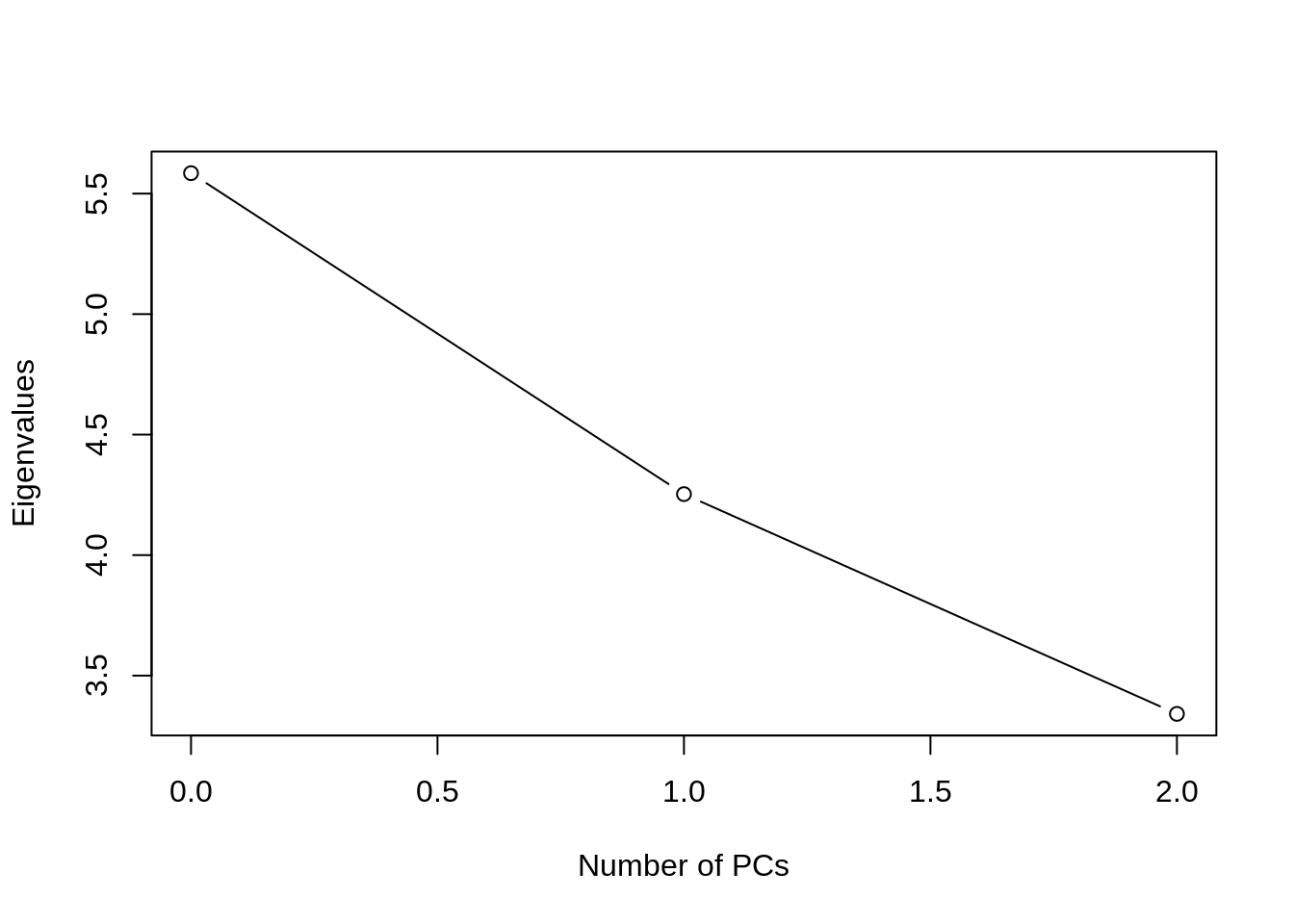

pca.select(pca)

## [1] 1 1

french$factor <- pca$x[,1]

french$factor <- scale(french$factor)

colnames(french)

## [1] "Date" "Agric" "Food" "Soda" "Beer" "Smoke" "Toys"

## [8] "Fun" "Books" "Hshld" "Clths" "Hlth" "MedEq" "Drugs"

## [15] "Chems" "Rubbr" "Txtls" "BldMt" "Cnstr" "Steel" "FabPr"

## [22] "Mach" "ElcEq" "Autos" "Aero" "Ships" "Guns" "Gold"

## [29] "Mines" "Coal" "Oil" "Util" "Telcm" "PerSv" "BusSv"

## [36] "Hardw" "Softw" "Chips" "LabEq" "Paper" "Boxes" "Trans"

## [43] "Whlsl" "Rtail" "Meals" "Banks" "Insur" "RlEst" "Fin"

## [50] "Other" "factor"

## Agric Food Soda Beer Smoke Toys

## 0.12021240 0.13155467 0.11531338 0.12442778 0.09174715 0.14971971

## Fun Books Hshld Clths Hlth MedEq

## 0.15280831 0.16031235 0.14662061 0.15301802 0.13344679 0.14256020

## Drugs Chems Rubbr Txtls BldMt Cnstr

## 0.12516812 0.16174124 0.16094593 0.14574188 0.16838879 0.15685418

## Steel FabPr Mach ElcEq Autos Aero

## 0.14548138 0.13559541 0.16614923 0.16256363 0.14603539 0.15356122

## Ships Guns Gold Mines Coal Oil

## 0.13608411 0.11944298 0.04928365 0.12869771 0.09540056 0.11383108

## Util Telcm PerSv BusSv Hardw Softw

## 0.10618328 0.12927581 0.14744673 0.17239912 0.12876272 0.12809929

## Chips LabEq Paper Boxes Trans Whlsl

## 0.14723511 0.15488890 0.15675136 0.14541913 0.16181750 0.16966150

## Rtail Meals Banks Insur RlEst Fin

## 0.15603055 0.15567743 0.15014514 0.15235295 0.14690598 0.16029714

## Other

## 0.14788972

modely <- lm(Fin~factor,data=french)

summary(modely)

##

## Call:

## lm(formula = Fin ~ factor, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -13.7553 -1.6724 0.0878 1.7345 15.0728

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.1078 0.1328 8.341 5.25e-16 ***

## factor 5.3737 0.1329 40.425 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 3.226 on 588 degrees of freedom

## Multiple R-squared: 0.7354, Adjusted R-squared: 0.7349

## F-statistic: 1634 on 1 and 588 DF, p-value: < 2.2e-16

modelx <- lm(Gold~factor,data=french)

summary(modelx)

##

## Call:

## lm(formula = Gold ~ factor, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -28.629 -6.427 -0.743 5.707 76.339

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.8529 0.4317 1.975 0.0487 *

## factor 2.8640 0.4321 6.628 7.72e-11 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 10.49 on 588 degrees of freedom

## Multiple R-squared: 0.06951, Adjusted R-squared: 0.06793

## F-statistic: 43.93 on 1 and 588 DF, p-value: 7.715e-11

Testing common factors

french <- fread('french.csv')

market <- fread('market.csv')

french <- merge(french,market,all=FALSE)

french$Mkt <- as.numeric(french$Mkt)

## Warning: NAs introduced by coercion

french$SMB <- as.numeric(french$SMB)

## Warning: NAs introduced by coercion

french$HML <- as.numeric(french$HML)

## Warning: NAs introduced by coercion

french$Date <- as.Date(french$Date)

french <- french[complete.cases(french)]

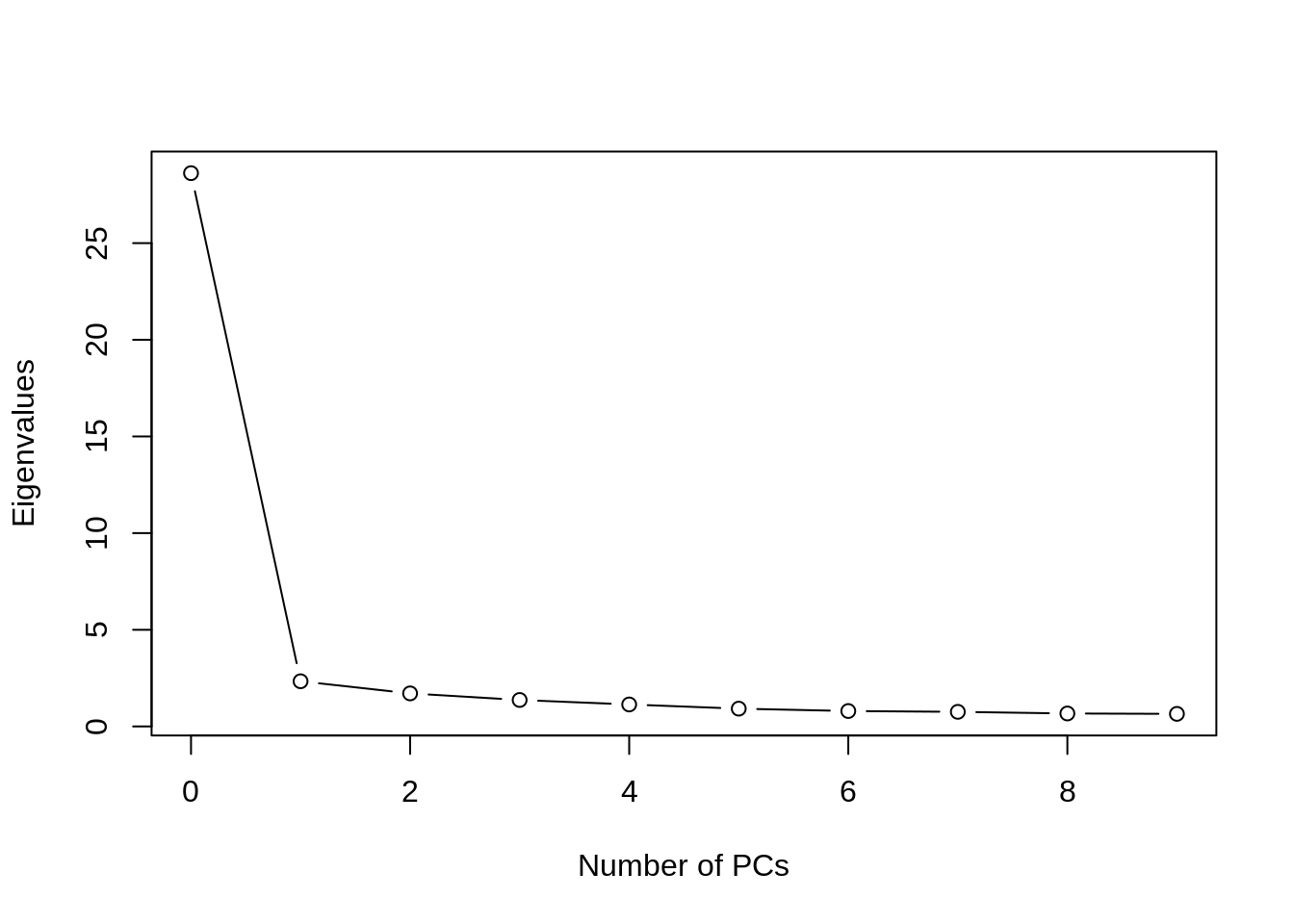

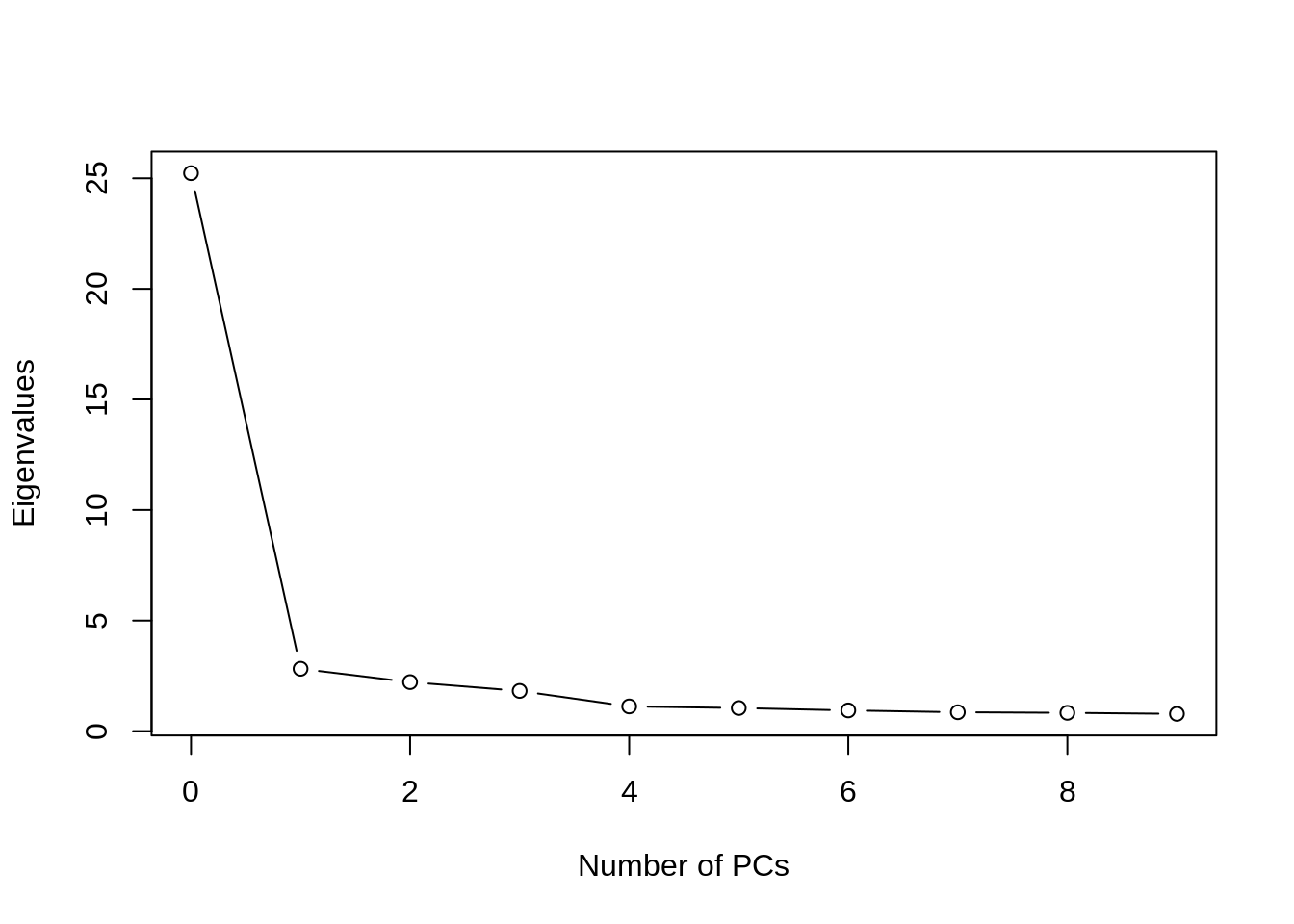

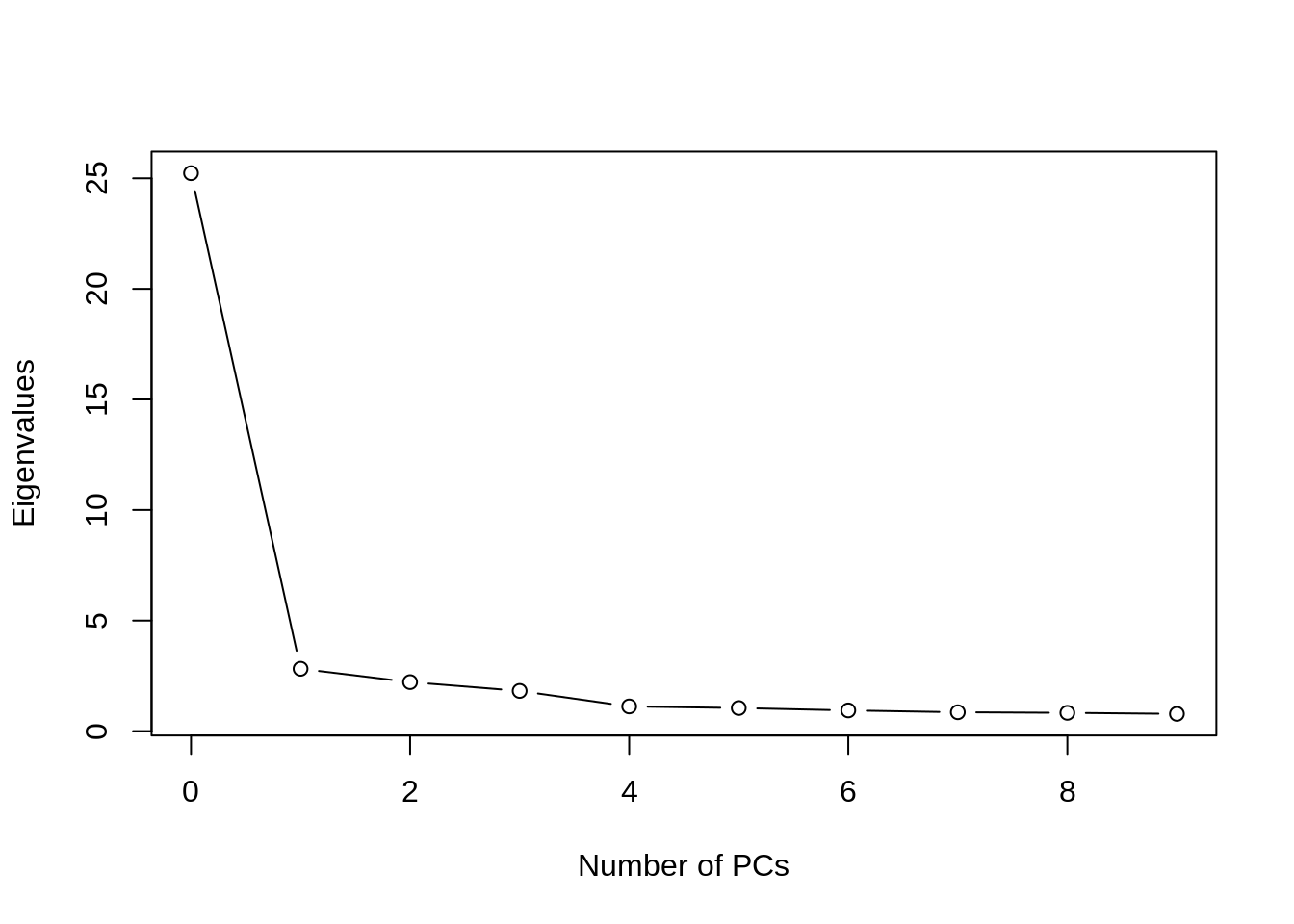

panel <- french[,2:50]

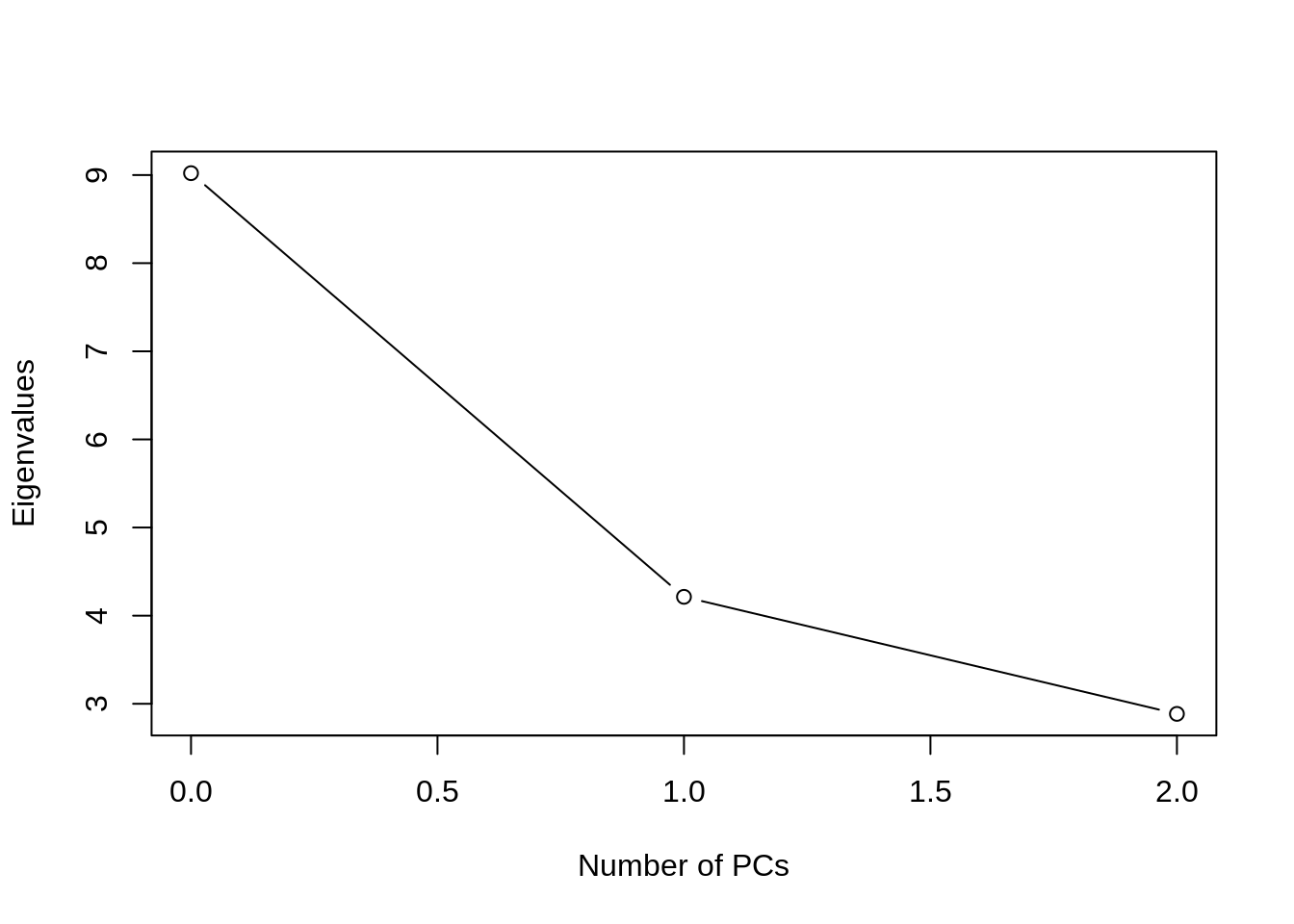

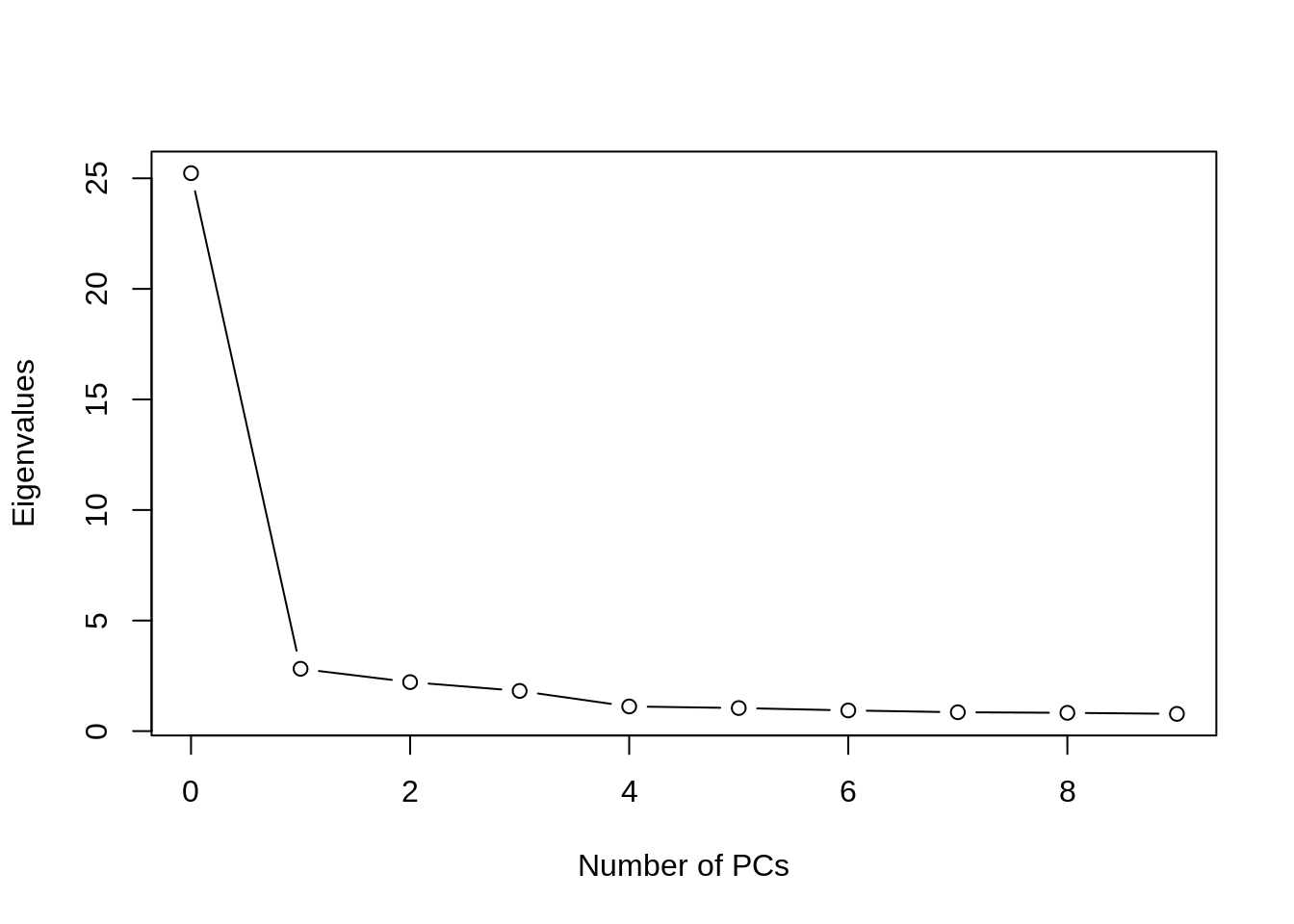

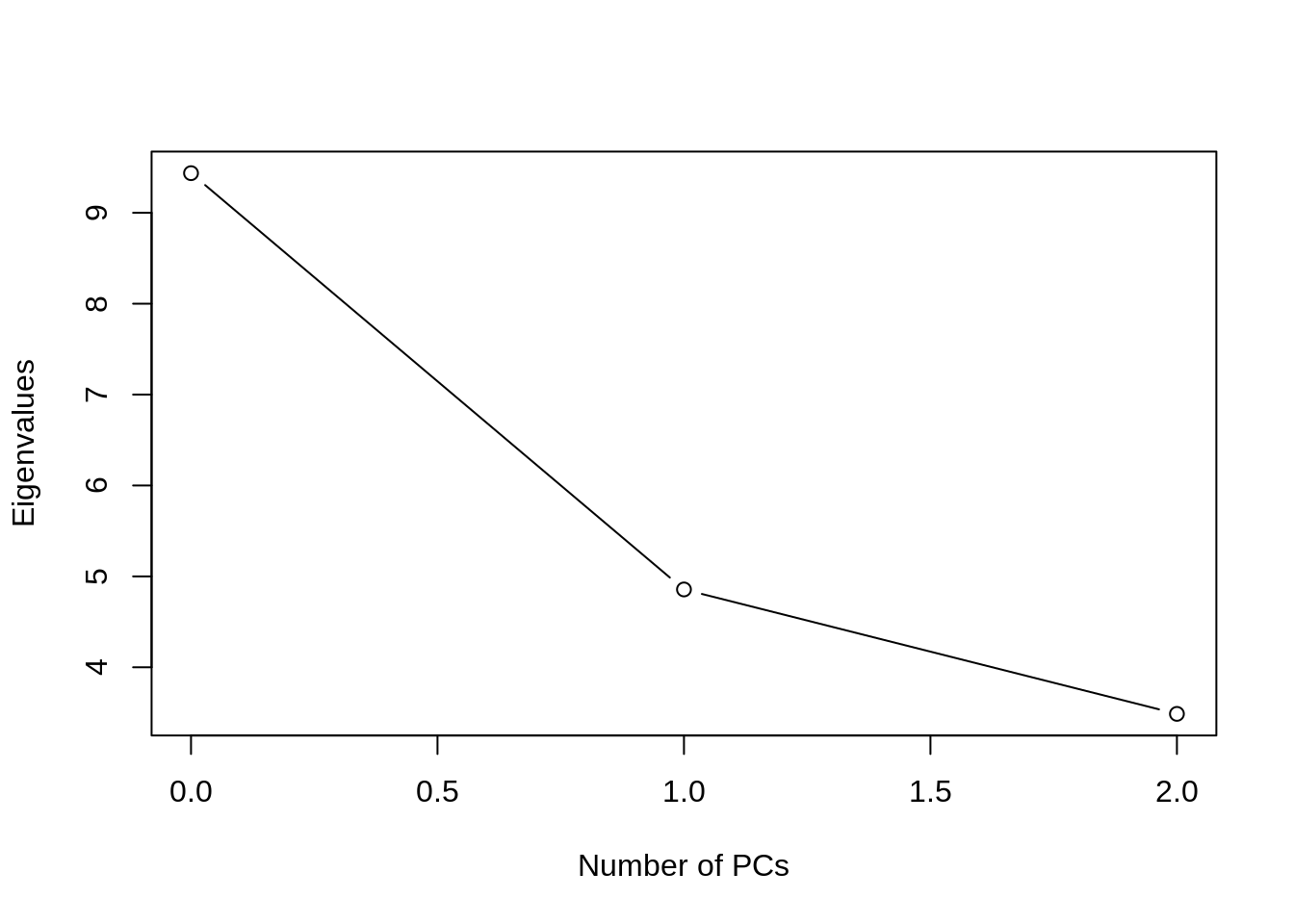

french$factor <- scale(prcomp(panel,scale=TRUE)$x[,1])

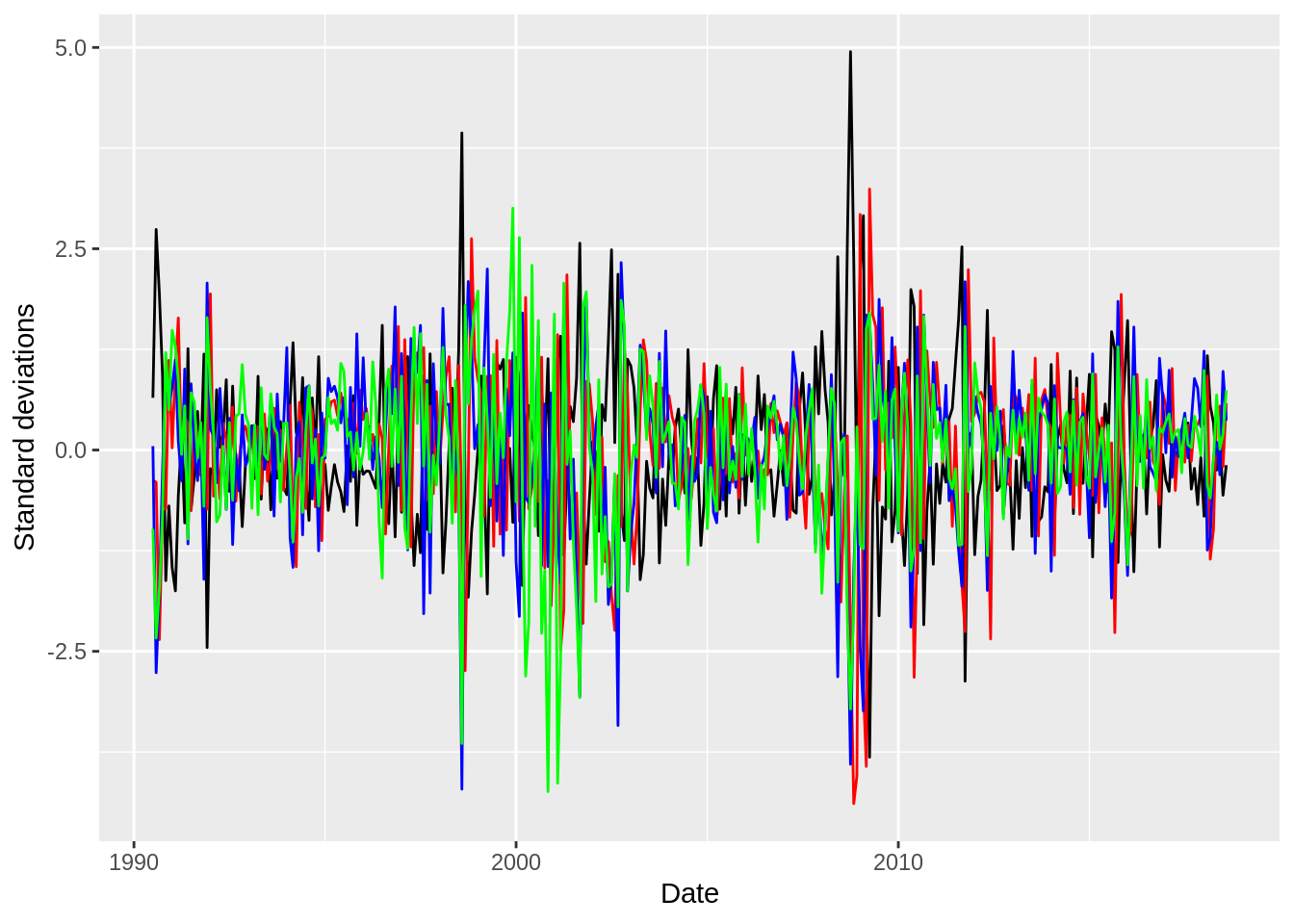

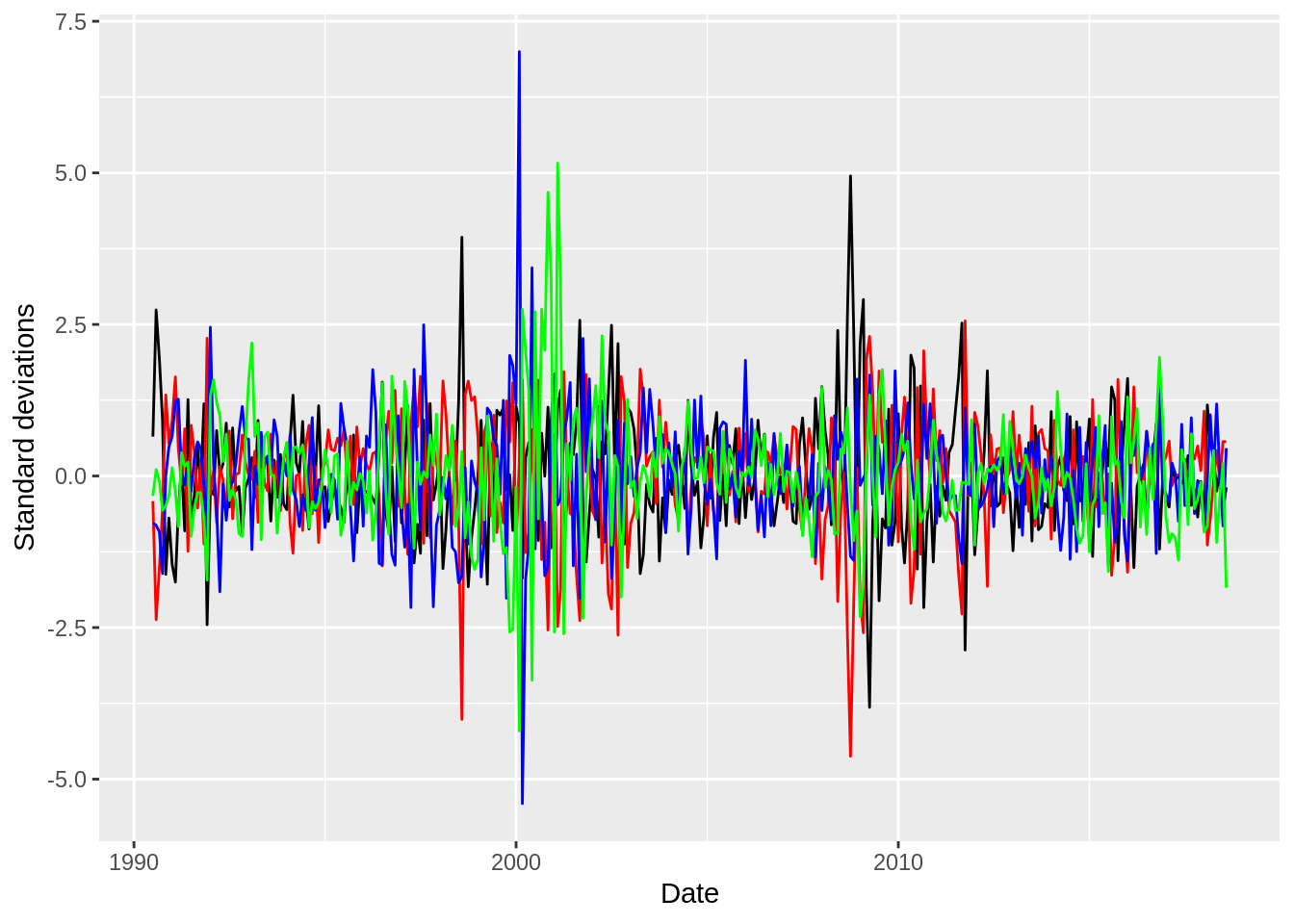

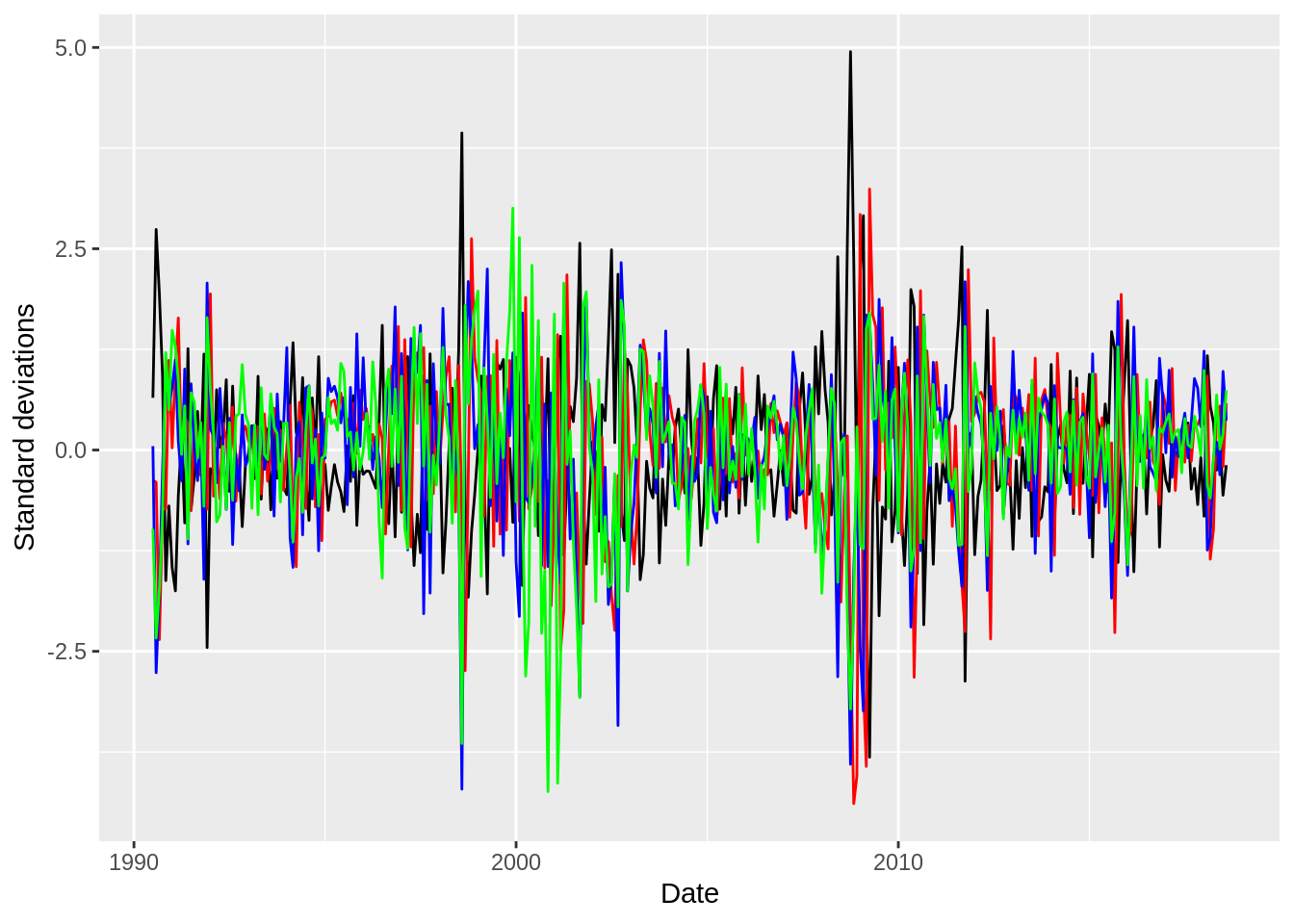

ggplot(french,aes(x=Date)) +

geom_line(aes(y=scale(factor)),color="black") +

geom_line(aes(y=scale(sp500)),color="red") +

geom_line(aes(y=scale(djia)),color="blue") +

geom_line(aes(y=scale(nasdaq)),color="green") +

scale_y_continuous('Standard deviations')

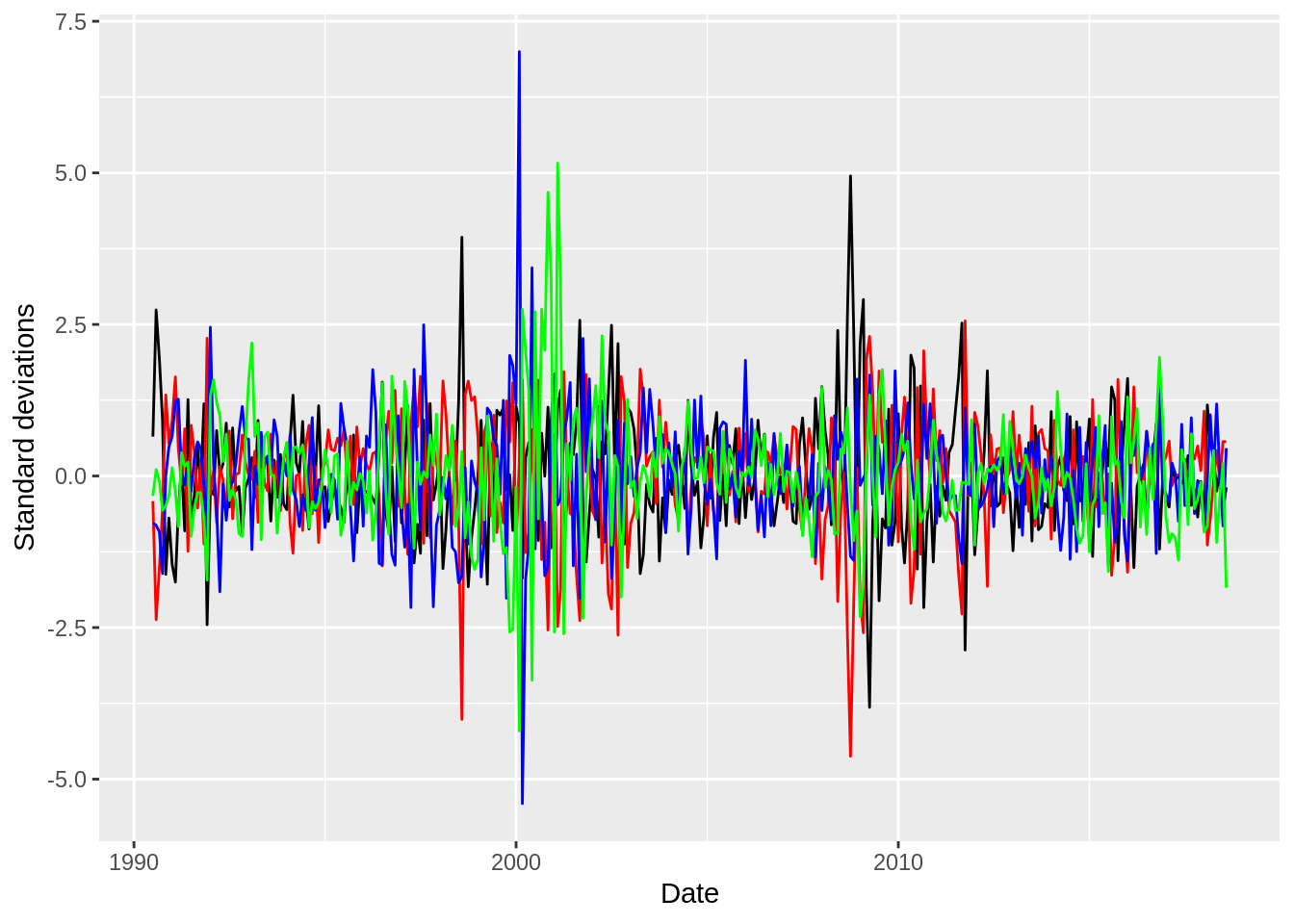

ggplot(french,aes(x=Date)) +

geom_line(aes(y=scale(factor)),color="black") +

geom_line(aes(y=scale(Mkt)),color="red") +

geom_line(aes(y=scale(SMB)),color="blue") +

geom_line(aes(y=scale(HML)),color="green") +

scale_y_continuous('Standard deviations')

summary(lm(Fin~factor,data=french))

##

## Call:

## lm(formula = Fin ~ factor, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -13.0272 -2.2469 0.0608 2.1385 15.1774

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.2347 0.2014 6.131 2.45e-09 ***

## factor -5.6832 0.2017 -28.180 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 3.702 on 336 degrees of freedom

## Multiple R-squared: 0.7027, Adjusted R-squared: 0.7018

## F-statistic: 794.1 on 1 and 336 DF, p-value: < 2.2e-16

summary(lm(Fin~sp500,data=french))

##

## Call:

## lm(formula = Fin ~ sp500, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -26.3147 -4.2093 0.3922 4.0427 22.0414

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.10241 0.36931 2.985 0.00304 **

## sp500 0.21836 0.08478 2.575 0.01044 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 6.724 on 336 degrees of freedom

## Multiple R-squared: 0.01936, Adjusted R-squared: 0.01644

## F-statistic: 6.633 on 1 and 336 DF, p-value: 0.01044

summary(lm(Fin~djia,data=french))

##

## Call:

## lm(formula = Fin ~ djia, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -14.1732 -2.6053 0.0351 2.2839 16.6701

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.36483 0.22505 1.621 0.106

## djia 1.33718 0.05494 24.337 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.085 on 336 degrees of freedom

## Multiple R-squared: 0.638, Adjusted R-squared: 0.637

## F-statistic: 592.3 on 1 and 336 DF, p-value: < 2.2e-16

summary(lm(Fin~nasdaq,data=french))

##

## Call:

## lm(formula = Fin ~ nasdaq, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -19.4251 -2.2702 0.0978 2.0964 20.9242

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.51370 0.22626 2.27 0.0238 *

## nasdaq 0.85070 0.03547 23.98 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.123 on 336 degrees of freedom

## Multiple R-squared: 0.6313, Adjusted R-squared: 0.6302

## F-statistic: 575.3 on 1 and 336 DF, p-value: < 2.2e-16

summary(lm(Fin~djia+nasdaq,data=french))

##

## Call:

## lm(formula = Fin ~ djia + nasdaq, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -17.8625 -2.2066 -0.3436 1.9587 16.5220

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.31291 0.19306 1.621 0.106

## djia 0.78479 0.06874 11.417 <2e-16 ***

## nasdaq 0.48525 0.04397 11.037 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 3.503 on 335 degrees of freedom

## Multiple R-squared: 0.7346, Adjusted R-squared: 0.733

## F-statistic: 463.5 on 2 and 335 DF, p-value: < 2.2e-16

summary(lm(Fin~Mkt+SMB+HML,data=french))

##

## Call:

## lm(formula = Fin ~ Mkt + SMB + HML, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -17.3274 -1.8534 -0.0451 1.8337 12.3187

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.08446 0.18004 -0.469 0.63928

## Mkt 1.42157 0.04403 32.289 < 2e-16 ***

## SMB 0.17703 0.06277 2.820 0.00508 **

## HML 0.13878 0.05824 2.383 0.01773 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 3.22 on 334 degrees of freedom

## Multiple R-squared: 0.7765, Adjusted R-squared: 0.7745

## F-statistic: 386.8 on 3 and 334 DF, p-value: < 2.2e-16

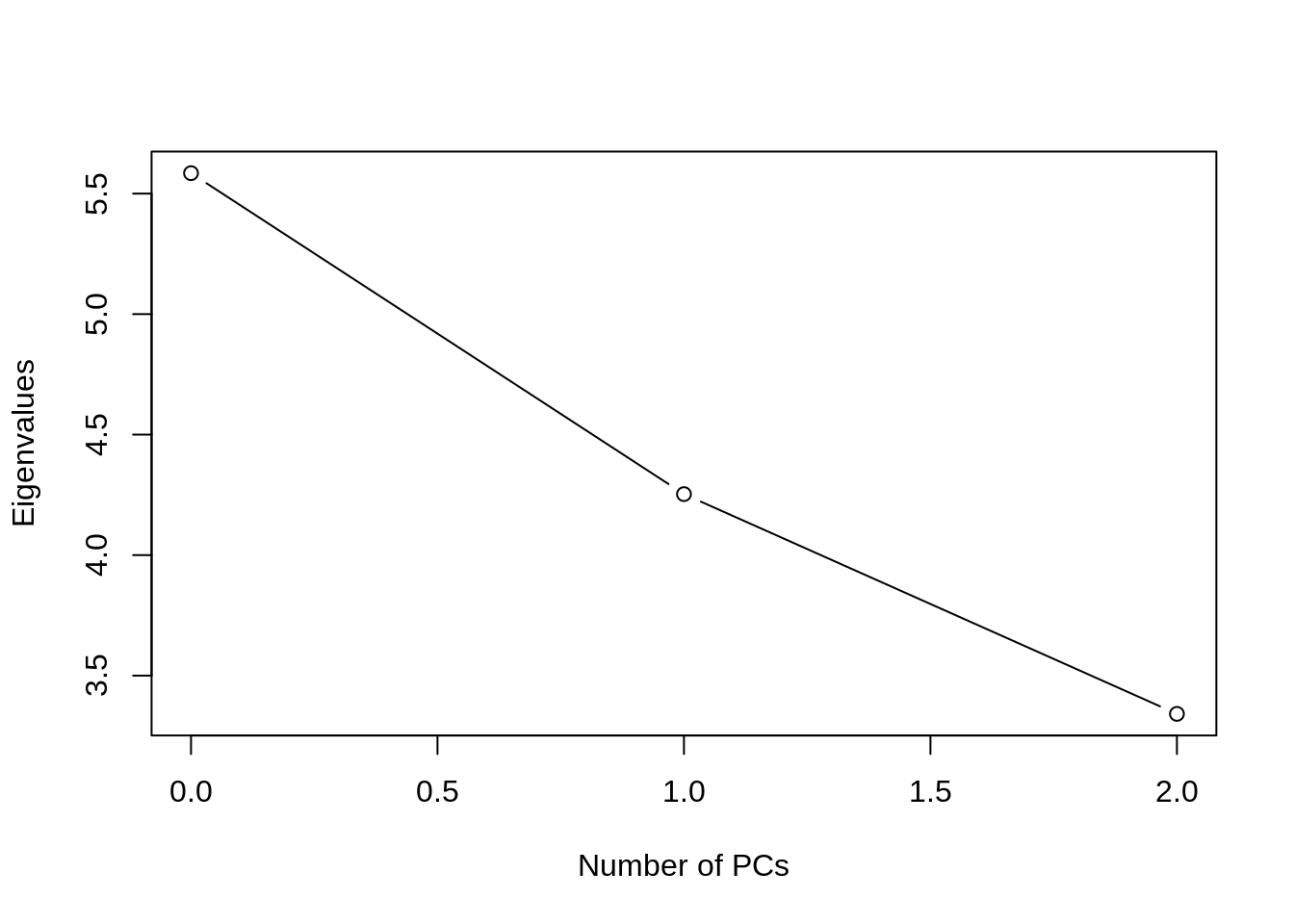

pc.test(panel,french$factor)

## [1] 0 0

pc.test(panel,french$djia)

## [1] 1 1

pc.test(panel,french[,.(djia,sp500,nasdaq)])

## [1] 1 1

pc.test(panel,french[,.(Mkt,HML)])

## [1] 0 0

summary(lm(factor~Mkt+HML,data=french))

##

## Call:

## lm(formula = factor ~ Mkt + HML, data = french)

##

## Residuals:

## Min 1Q Median 3Q Max

## -1.2884 -0.1527 -0.0076 0.1525 0.7906

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.223657 0.013745 16.27 <2e-16 ***

## Mkt -0.238852 0.003303 -72.31 <2e-16 ***

## HML -0.055054 0.004277 -12.87 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.2458 on 335 degrees of freedom

## Multiple R-squared: 0.9399, Adjusted R-squared: 0.9396

## F-statistic: 2622 on 2 and 335 DF, p-value: < 2.2e-16